louisiana estate tax rate

Louisiana Real Property Taxes In Louisiana the median property tax rate is 551 per 100000 of assessed home value. On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832.

Louisiana S Tax Reform Breakthrough Wsj

6 2022 to claim millions of dollars in state income tax refunds before they become unclaimed property.

. The underlying income tax brackets are unchanged from last year. Most local parishes add about 5 for an average total sales tax of about 10. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

Whether you are already a resident or just considering moving to Louisiana to live or invest in real estate estimate local property tax rates and learn. However because of the varying tax. You can look up your recent.

Property Taxes by State How. Revenue Information Bulletin 18-017. The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate.

The Louisiana tax rates decreased from 2 4 and 6 last year to 185 35 and 425 this year. BATON ROUGE Louisiana taxpayers have until Oct. Louisiana Property Taxes Go To Different State 24300 Avg.

Learn all about Louisiana real estate tax. Louisiana property tax rates are set by different taxing districts depending on the amount of revenue they need to generate from property taxes. Louisiana Property Tax Breaks for Retirees.

Of all the states connecticut has the highest exemption amount of 91 million. Groceries are exempt from the Louisiana sales tax Counties and cities can charge an. This ratio is applied to the.

If taxes are not paid by the Louisiana property tax due date an interest rate of 1 per month will be computed until they are paid. The Louisiana Department of. The median property tax in Louisiana is 24300 per year based on a median home value of 13540000 and a median effective property tax rate of 018.

018 of home value Tax amount varies by county The median property tax in Louisiana is 24300 per year for a home worth. In Louisiana an average property tax bill ranges between 832 and 1822. What are the louisiana tax brackets.

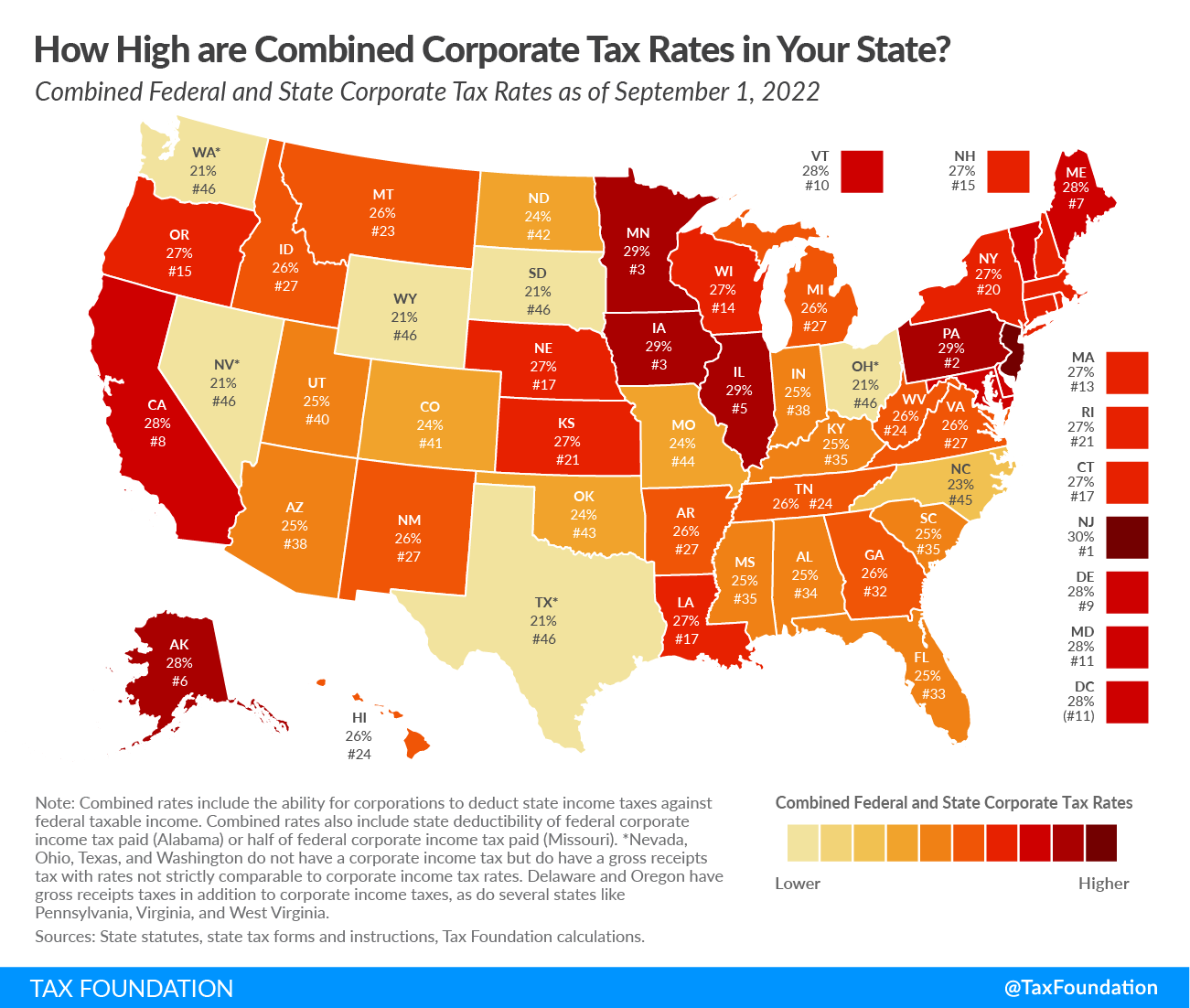

Subsequently the total tax rate. The states property tax rate for 2016 is set. Louisiana also has a corporate income tax that ranges from 350 percent to 750 percent.

Louisiana has a 445 statewide sales tax rate and local parishes can add up to an additional 7. 2 percent on the first 10000 4 percent on the next 40000 6 percent on the excess over 50000 For periods beginning on or after January 1 2022 fiduciaries are taxed on net income. Every year state and local governments in the United States collect 42 billion in revenue.

Louisiana has a 445 percent state sales tax rate a max local sales tax rate of 700 percent. The Louisiana state sales tax rate is 4 and the average LA sales tax after local surtaxes is 891. Louisiana Estate Tax Rate.

Louisiana Ranks 3rd Overall Cheapest In Property Tax Rankings Livingston Parish Ninth Most Expensive Statewide News Livingstonparishnews Com

Property Taxes Urban Institute

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Where S My Refund Louisiana H R Block

Louisiana Tax Rates Rankings Louisiana State Taxes Tax Foundation

Louisiana Estate Tax Planning Vicknair Law Firm

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Pike County Collector Pike County Collector

Louisiana Income Tax Calculator Smartasset

Property Tax Calculator Estimator For Real Estate And Homes

State Sales Tax Rates Tax Policy Center

Louisiana Tax Changes Impacting The Hospitality Industry Louisiana Law Blog

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

State Death Tax Hikes Loom Where Not To Die In 2021

How Do State And Local Property Taxes Work Tax Policy Center

Are There Any States With No Property Tax In 2022 Free Investor Guide

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation